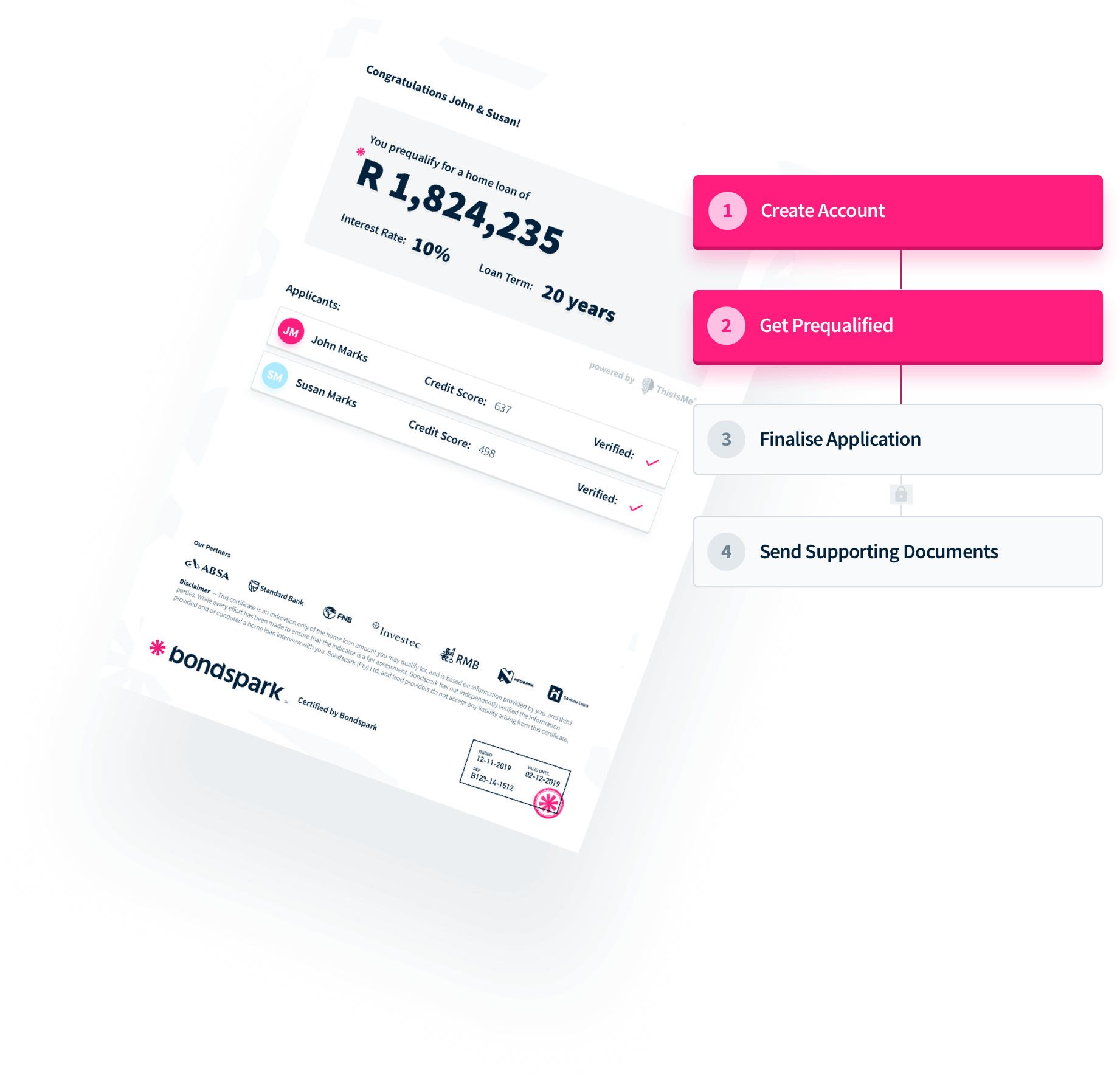

Prequalify for a home loan instantly online!

Get a prequalification certificate and complete half of your final application in one step

Need more information?

What is a prequalification?

Getting prequalified involves supplying bondspark with your current income, expenses, assets and liabilities. We then assess your credit worthiness and calculate what you can afford.

What can I do with a prequalification?

We take into account your income and expenses to calculate whether you will be able to repay your home loan. Your repayment cannot be higher than 30% of your gross monthly income.

How accurate is a prequalification?

A prequalification will always be just an indication of what you can afford. We will always try to make it more accurate, but only the banks or lenders can decide if they would grant you a bond.

Will this prequalification affect my credit score?

To make our prequalification as accurate as possible, we have to do a credit check, which does affect your credit score, but only marginally.

How is the prequalification calculated?

We use two different calculations to determine whether you qualify for a home loan. First, we use a compound interest formula to determine what you can afford (can’t be more than 30% of your gross income), then we look at your credit score to determine if you have a good history of paying back loans. That’s it.

Why do I need to do a credit check?

“Creditworthiness”, or your ability to borrow and repay the money, is determined by the credit bureau and we have to request that information to make sure that you are not wasting your time applying.

What happens after prequalification?

Your prequalification requires the same information as your final application to the banks - 50% of the information to be exact. So once you have a signed Offer to Purchase (OTP) from the seller, you can simply return to your prequalification and continue with the rest of your application.

What is a good credit score?

Credit scores differ depending on which credit bureau you ask. We obtain your credit score through ThisIsMe and, in the context of this home loan application, a good credit score is above 620.

How long is a prequalification valid for?

On average, you have 21 days to complete a home loan application. However, should you need it, there's an automatic extension of an additional 21 days. As a result of this, your prequalification will be valid for 42 days.

We love our clients, and they love us.

What's not to like about that?

- NR MothabengHi Neo, thank you and God bless you for your patience, dedication and professionalism.SavedR 328 p/mInterest Rate: 9.3%

- Mandla MatlouThank you so much, Neo, my bond advisor, for all the effort you put in.SavedR 947 p/mInterest Rate: 10.66%

- Latoya HendricksIt's been a pleasant experience working with you — your team is just one of a kind, with such a great way about you. I will definitely refer people to Bondspark.SavedR 742 p/mInterest Rate: 8.54%

- Phumzile RapopoThank you so much Kyle and the Bondspark team. It has been great working with you all.SavedR 513 p/mInterest Rate: 11%

- Sanette BothaIt has been a pleasure working with all of you. We will surely recommend you to other people. Thank you for the assistance.SavedR 609 p/mInterest Rate: 9.08%

- NR MothabengHi Neo, thank you and God bless you for your patience, dedication and professionalism.SavedR 328 p/mInterest Rate: 9.3%

- Mandla MatlouThank you so much, Neo, my bond advisor, for all the effort you put in.SavedR 947 p/mInterest Rate: 10.66%

We’re a social bunch, get in touch — let’s chat.

Get a home loan specialist to call you back and answer any questions you still might have.

We respond within one business day, so keep an eye on your mobile. Or message us at hello@bondspark.co.za

Still looking for a property?

What can I afford?What will my monthly repayments be?How much can I save with Bondspark?Become a master at home loansReady to apply?

Apply online now!arrow_forward

© 2024 Bondspark, Ltd.

•

Privacy Policy•

Terms & Conditions•

Get in touch:

hello@bondspark.co.za•

010 880 3820